Foreıgn Trade Dersi 7. Ünite Özet

Foreign Exchange Market And Foreign Exchange Rate

Açıköğretim ders notları öğrenciler tarafından ders çalışma esnasında hazırlanmakta olup diğer ders çalışacak öğrenciler için paylaşılmaktadır. Sizlerde hazırladığınız ders notlarını paylaşmak istiyorsanız bizlere iletebilirsiniz.

Açıköğretim derslerinden Foreıgn Trade Dersi 7. Ünite Özet için hazırlanan ders çalışma dokümanına (ders özeti / sorularla öğrenelim) aşağıdan erişebilirsiniz. AÖF Ders Notları ile sınavlara çok daha etkili bir şekilde çalışabilirsiniz. Sınavlarınızda başarılar dileriz.

Foreign Exchange Market And Foreign Exchange Rate

Foreign Exchange Market and Foreign Exchange Rate

The link between national and international markets with open economy is established by the foreign exchange market in which various currencies of different countries are bought and sold. Foreign exchange markets undertake an important function for both national and international economies. They make international transaction possible by transferring the local currency to foreign currencies or vice versa.

In order to buy a unit of currency, the amount that must be foregone in the other currency is the foreign exchange rate . In other words, the foreign exchange rate is the price of one unit of currency in terms of the other.

Foreign exchange rate can be explained in two different ways: direct and indirect. If we explain the value of one unit of foreign currency in terms of domestic currency, it is the direct foreign exchange rate (1$ = 5.65? shown as $/?). On the contrary, if we explain the value of one unit of domestic currency in terms of foreign currency, it is the indirect exchange rate (1? = 0.18$ or 1? = 0.16€ shown as ?/$ or ?/€).

The value of foreign currency units in terms of each other is called cross foreign exchange rate (in short, cross rate).

The foreign exchange rate allows to determine how much a good, service or financial asset whose value is expressed in terms of a foreign currency will cost in domestic currency.

The definition of foreign exchange rate above is known as the nominal exchange rate; however, there is another foreign exchange rate concept which is the real exchange rate. Real foreign exchange rate is the value of a domestic currency against foreign currencies corrected for the purchasing power. (See page 182 of the book for the formulas to calculate the real foreign exchange).

In the foreign exchange market, there is another differentiation on the exchange rates: spot and forward exchange rates. Spot exchange rate is the current exchange rate today for immediate delivery. Forward exchange rate on the other hand, is the exchange rate settled today for a payment or delivery that will be consummated on a future date.

Foreign Exchange Rates in the Long Run

In the determination process of the foreign exchange rate, it is required to differentiate the long- and short-term analyses to understand the factor affecting the level of exchange rates.

Fundamental economic variables of two countries are the basic factors affecting the level of exchange rate. When there is an excess demand in the market for a foreign currency, the price of that foreign currency will start to increase until excess demand disappears (See Figure 7.4 on page 185 of the book).

Factors that cause a change in the equilibrium exchange rate are the factors which are accepted as constant other than the current exchange rate. In macroeconomics, these factors include the real GDP, relative productivity, relative price level, barriers for international trade (like tariffs and quotas) and preferences between imported and domestically produced goods.

To take GDP as an example, the real output (GDP) level of a country is an indicator reflecting the productivity of resources she has. Therefore, an increase in the real GDP shifts the supply and demand curves. Supposing that US economy grows faster than the Turkish economy, Americans would demand more of Turkish goods and this would cause an increase in the supply of dollars in Turkey. As a result, an appreciation in ? would be observed (see Figure 7.5 on page 186 of the book).

In a similar way, price increases in two countries, barriers to free trade, preferences between imported and domestically produced goods and relative productivity affect the demand and supply of foreign exchange and cause a change in the equilibrium level of foreign exchange rate (see Table 7.1 on page 187 of the book for factors affecting the long run exchange rate).

A theory, known as purchasing power parity, however, claims that the foreign exchange rate will solely be determined by the price level changes in both countries. Purchasing Power Parity (PPP) Theory is based on a principle known as “law of one price” . This law claims that the entirely homogeneous (identical) goods should be sold with the same price even in different markets. The Purchasing Power Theory based on the law of one price investigates the relationship between the prices of not only the identical goods but also the prices of all goods among countries, which are measured by the general price levels. According the PPP Theory, domestic price level will be equal to the product of the exchange rate and the level of foreign price level.

If the PPP Theory holds, the Us dollar has the same purchasing power in both countries. In other words, foreign exchange rate is determined in a level so that it has the same purchasing power in both countries. It means that it is possible to buy exactly the same quantity of a good in both countries if we convert Turkish lira to the US dollar or vice versa at the market price.

Foreign Exchange Rates in the Short Run

Foreign exchange rates can significantly fluctuate in the short and even in the very short run. Because of the fact that the long-term factors affecting the level of exchange rates (like real GDP, relative productivity, relative prices) cannot change in daily or hourly basis, it is not possible to explain the short-run fluctuations in exchange rates by using these factors. It is clear that we need an approach to explain these movements in the determination of foreign exchange rates. The interest rate parity approach is a very useful and practical tool to use for this purpose.

According to the portfolio preference theory, there are a couple of factors affecting the demand for an asset. The basic factor that affects the demand for Turkish lira and US dollar as an example of domestic currency and foreign currency respectively, is the expected rate of return that could be obtained by holding them. If Turkish or foreign investors expect that the return of ? deposits will be higher than $ deposits, there will be higher demand for T deposits and lower demand for $ deposits. Therefore, we can explain the changes in the demand for these deposits if we compare the expected returns that will be obtained by holding these assets.

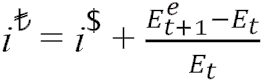

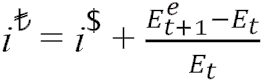

Each deposit holder converts this return to his/her own currency to compare the return he/she obtained. The expected return of this asset in terms of Turkish lira will depend on the total of two factors: the interest rate for this type of deposits and the expected rate of change in the value of Turkish lira. In this context, the interest parity condition states that the domestic interest rate is equal to the total of foreign interest rate and to the expected rate of change in the foreign exchange rate. (see page 191 of the book for the equation formula).

The expected return of ? deposits (R ? ) is equal to the interest rate for these deposits (i ? ). Therefore, the level of current exchange rate has no effect in the determination of return rate of Turkish lira deposits. If we assume that the interest rate for ? deposits is 10%, for various levels of current exchange rate (0.95, 1.00 and 1.05) the return rate for ? deposits is 10% and these combinations produce points X, B, and Y in the Figure. Connecting these points creates the expected return curve for Turkish lira deposits as a straight line (R ? ). (see Figure 7.7 for the expected return curves of $ and ? assets)

Changes in the Equilibrium Foreign Exchange Rate

In order for a change to occur in the equilibrium exchange rate, one or both of the curves R ? and R $ must shift to the right or left. There are two factors that shift the R $ curve: The interest rate paid for dollar deposits (i $ ) and the expected foreign exchange rate ![]() . On the other hand, the interest rate paid for Turkish lira deposits (i ? ) is the only factor that shifts the R ? curve.

. On the other hand, the interest rate paid for Turkish lira deposits (i ? ) is the only factor that shifts the R ? curve.

Considering the interest parity condition, an increase in i $ also means an increase in the expected return of dollar nominated deposits.

A change in the expected future exchange rate ![]() also affects the expected return of foreign exchange nominated assets. You will notice in the interest rate parity equation, that an increase in

also affects the expected return of foreign exchange nominated assets. You will notice in the interest rate parity equation, that an increase in ![]() (that is, expecting a depreciation in the domestic currency) also causes an increase in the expected return of dollar deposits.

(that is, expecting a depreciation in the domestic currency) also causes an increase in the expected return of dollar deposits.

Changes in expected foreign exchange rates are the most important factor in a globalized world in order to explain the fluctuations in foreign exchange rates, especially, in the short run. For instance, a negative change in the risk perception of foreign investors may change the expected foreign exchange rate and cause massive capital outflows from the domestic country.

The last factor changing the equilibrium exchange rate in the interest rate parity approach is the changes in domestic interest rate (i ? ) paid for Turkish lira assets. it can be said that every increase in the domestic interest may not always create the same conclusion. In order to reach a precise judgment in this issue, the source of the change in domestic interest rate should be reviewed.

To see the source of the change in the domestic interest rate, the Fisher Equation helps us. According to Fisher Equation, the nominal interest rate in an economy is equal to the sum of the real interest rate and the expected inflation:

i = i r +? e

where i r and ? e stand for the real interest rate and inflation expectations, respectively. Changes in the interest rate may occur depending on two factors: Changes in the real interest rate (i r ) and changes in the inflationary expectations (? e ).

The result may be different if the change in the nominal interest rate comes from the changes in expected inflation. An increase in the inflationary expectations induces the expected depreciation of the domestic currency, therefore, we can easily say that an increase in ? e causes an increase in ![]() .

.

Determination of Forward Foreign Exchange Rates

Interest parity condition presents us a very useful analytical tool to investigate the short run determinants of the changes in foreign exchange rates. There is an additional use of the interest rate parity condition that serves as an important tool in the foreign exchange rate risk management. Remember the interest rate parity condition and think of the observability of the variables in this equation:

All the variables in this equation are observable except for the expected foreign exchange rate ![]() .Therefore, it can be calculated by using the knowns in the equation.

.Therefore, it can be calculated by using the knowns in the equation.

To calculate the forward exchange rate for $/? parity, we need spot rates that can be obtained from the banks’ quotations. Quotation is the price offer of a bank related to a financial asset. For instance, when one says the US dollar quotation, we understand that it is the price offer that a bank buys (bid rate) and sells (ask rate) the US dollar.

On the other hand, for instance, when one says 120-day interest rate quotation, we understand that a bank wants to pay the interest rate to borrow (bid rate) and the interest rate to lend (ask rate).

Foreign Exchange Market and Foreign Exchange Rate

The link between national and international markets with open economy is established by the foreign exchange market in which various currencies of different countries are bought and sold. Foreign exchange markets undertake an important function for both national and international economies. They make international transaction possible by transferring the local currency to foreign currencies or vice versa.

In order to buy a unit of currency, the amount that must be foregone in the other currency is the foreign exchange rate . In other words, the foreign exchange rate is the price of one unit of currency in terms of the other.

Foreign exchange rate can be explained in two different ways: direct and indirect. If we explain the value of one unit of foreign currency in terms of domestic currency, it is the direct foreign exchange rate (1$ = 5.65? shown as $/?). On the contrary, if we explain the value of one unit of domestic currency in terms of foreign currency, it is the indirect exchange rate (1? = 0.18$ or 1? = 0.16€ shown as ?/$ or ?/€).

The value of foreign currency units in terms of each other is called cross foreign exchange rate (in short, cross rate).

The foreign exchange rate allows to determine how much a good, service or financial asset whose value is expressed in terms of a foreign currency will cost in domestic currency.

The definition of foreign exchange rate above is known as the nominal exchange rate; however, there is another foreign exchange rate concept which is the real exchange rate. Real foreign exchange rate is the value of a domestic currency against foreign currencies corrected for the purchasing power. (See page 182 of the book for the formulas to calculate the real foreign exchange).

In the foreign exchange market, there is another differentiation on the exchange rates: spot and forward exchange rates. Spot exchange rate is the current exchange rate today for immediate delivery. Forward exchange rate on the other hand, is the exchange rate settled today for a payment or delivery that will be consummated on a future date.

Foreign Exchange Rates in the Long Run

In the determination process of the foreign exchange rate, it is required to differentiate the long- and short-term analyses to understand the factor affecting the level of exchange rates.

Fundamental economic variables of two countries are the basic factors affecting the level of exchange rate. When there is an excess demand in the market for a foreign currency, the price of that foreign currency will start to increase until excess demand disappears (See Figure 7.4 on page 185 of the book).

Factors that cause a change in the equilibrium exchange rate are the factors which are accepted as constant other than the current exchange rate. In macroeconomics, these factors include the real GDP, relative productivity, relative price level, barriers for international trade (like tariffs and quotas) and preferences between imported and domestically produced goods.

To take GDP as an example, the real output (GDP) level of a country is an indicator reflecting the productivity of resources she has. Therefore, an increase in the real GDP shifts the supply and demand curves. Supposing that US economy grows faster than the Turkish economy, Americans would demand more of Turkish goods and this would cause an increase in the supply of dollars in Turkey. As a result, an appreciation in ? would be observed (see Figure 7.5 on page 186 of the book).

In a similar way, price increases in two countries, barriers to free trade, preferences between imported and domestically produced goods and relative productivity affect the demand and supply of foreign exchange and cause a change in the equilibrium level of foreign exchange rate (see Table 7.1 on page 187 of the book for factors affecting the long run exchange rate).

A theory, known as purchasing power parity, however, claims that the foreign exchange rate will solely be determined by the price level changes in both countries. Purchasing Power Parity (PPP) Theory is based on a principle known as “law of one price” . This law claims that the entirely homogeneous (identical) goods should be sold with the same price even in different markets. The Purchasing Power Theory based on the law of one price investigates the relationship between the prices of not only the identical goods but also the prices of all goods among countries, which are measured by the general price levels. According the PPP Theory, domestic price level will be equal to the product of the exchange rate and the level of foreign price level.

If the PPP Theory holds, the Us dollar has the same purchasing power in both countries. In other words, foreign exchange rate is determined in a level so that it has the same purchasing power in both countries. It means that it is possible to buy exactly the same quantity of a good in both countries if we convert Turkish lira to the US dollar or vice versa at the market price.

Foreign Exchange Rates in the Short Run

Foreign exchange rates can significantly fluctuate in the short and even in the very short run. Because of the fact that the long-term factors affecting the level of exchange rates (like real GDP, relative productivity, relative prices) cannot change in daily or hourly basis, it is not possible to explain the short-run fluctuations in exchange rates by using these factors. It is clear that we need an approach to explain these movements in the determination of foreign exchange rates. The interest rate parity approach is a very useful and practical tool to use for this purpose.

According to the portfolio preference theory, there are a couple of factors affecting the demand for an asset. The basic factor that affects the demand for Turkish lira and US dollar as an example of domestic currency and foreign currency respectively, is the expected rate of return that could be obtained by holding them. If Turkish or foreign investors expect that the return of ? deposits will be higher than $ deposits, there will be higher demand for T deposits and lower demand for $ deposits. Therefore, we can explain the changes in the demand for these deposits if we compare the expected returns that will be obtained by holding these assets.

Each deposit holder converts this return to his/her own currency to compare the return he/she obtained. The expected return of this asset in terms of Turkish lira will depend on the total of two factors: the interest rate for this type of deposits and the expected rate of change in the value of Turkish lira. In this context, the interest parity condition states that the domestic interest rate is equal to the total of foreign interest rate and to the expected rate of change in the foreign exchange rate. (see page 191 of the book for the equation formula).

The expected return of ? deposits (R ? ) is equal to the interest rate for these deposits (i ? ). Therefore, the level of current exchange rate has no effect in the determination of return rate of Turkish lira deposits. If we assume that the interest rate for ? deposits is 10%, for various levels of current exchange rate (0.95, 1.00 and 1.05) the return rate for ? deposits is 10% and these combinations produce points X, B, and Y in the Figure. Connecting these points creates the expected return curve for Turkish lira deposits as a straight line (R ? ). (see Figure 7.7 for the expected return curves of $ and ? assets)

Changes in the Equilibrium Foreign Exchange Rate

In order for a change to occur in the equilibrium exchange rate, one or both of the curves R ? and R $ must shift to the right or left. There are two factors that shift the R $ curve: The interest rate paid for dollar deposits (i $ ) and the expected foreign exchange rate ![]() . On the other hand, the interest rate paid for Turkish lira deposits (i ? ) is the only factor that shifts the R ? curve.

. On the other hand, the interest rate paid for Turkish lira deposits (i ? ) is the only factor that shifts the R ? curve.

Considering the interest parity condition, an increase in i $ also means an increase in the expected return of dollar nominated deposits.

A change in the expected future exchange rate ![]() also affects the expected return of foreign exchange nominated assets. You will notice in the interest rate parity equation, that an increase in

also affects the expected return of foreign exchange nominated assets. You will notice in the interest rate parity equation, that an increase in ![]() (that is, expecting a depreciation in the domestic currency) also causes an increase in the expected return of dollar deposits.

(that is, expecting a depreciation in the domestic currency) also causes an increase in the expected return of dollar deposits.

Changes in expected foreign exchange rates are the most important factor in a globalized world in order to explain the fluctuations in foreign exchange rates, especially, in the short run. For instance, a negative change in the risk perception of foreign investors may change the expected foreign exchange rate and cause massive capital outflows from the domestic country.

The last factor changing the equilibrium exchange rate in the interest rate parity approach is the changes in domestic interest rate (i ? ) paid for Turkish lira assets. it can be said that every increase in the domestic interest may not always create the same conclusion. In order to reach a precise judgment in this issue, the source of the change in domestic interest rate should be reviewed.

To see the source of the change in the domestic interest rate, the Fisher Equation helps us. According to Fisher Equation, the nominal interest rate in an economy is equal to the sum of the real interest rate and the expected inflation:

i = i r +? e

where i r and ? e stand for the real interest rate and inflation expectations, respectively. Changes in the interest rate may occur depending on two factors: Changes in the real interest rate (i r ) and changes in the inflationary expectations (? e ).

The result may be different if the change in the nominal interest rate comes from the changes in expected inflation. An increase in the inflationary expectations induces the expected depreciation of the domestic currency, therefore, we can easily say that an increase in ? e causes an increase in ![]() .

.

Determination of Forward Foreign Exchange Rates

Interest parity condition presents us a very useful analytical tool to investigate the short run determinants of the changes in foreign exchange rates. There is an additional use of the interest rate parity condition that serves as an important tool in the foreign exchange rate risk management. Remember the interest rate parity condition and think of the observability of the variables in this equation:

All the variables in this equation are observable except for the expected foreign exchange rate ![]() .Therefore, it can be calculated by using the knowns in the equation.

.Therefore, it can be calculated by using the knowns in the equation.

To calculate the forward exchange rate for $/? parity, we need spot rates that can be obtained from the banks’ quotations. Quotation is the price offer of a bank related to a financial asset. For instance, when one says the US dollar quotation, we understand that it is the price offer that a bank buys (bid rate) and sells (ask rate) the US dollar.

On the other hand, for instance, when one says 120-day interest rate quotation, we understand that a bank wants to pay the interest rate to borrow (bid rate) and the interest rate to lend (ask rate).